Market Information on the Office Furniture Industry in Asia-Pacific Source by CSIL

OFFICE FURNITURE TOWARDS SUSTAINABILITY

As a general trend, over the recent years, a strong move towards the “sustainability” of furniture production has been noticed worldwide and the share of investments in sustainability on total company turnover of sector companies has increased significantly. This type of investment includes both energy-saving technologies in production plants (e.g. LED light installations and photovoltaic panels), as well as in the product development decisions and related material procurement policies. This has proven to be a real transformation in the way business is conducted by drastically reducing the energy impact and definitively pushing away the logic of “disposable” products.

On the other hand, there has also been a significant increase in the presence of partially, if not totally, recyclable products in the office furniture market. According to a recent CSIL survey they already compose the majority of the global supply.

The usage of recycled metal materials has become more frequently reported in office furniture companies’ communication. However, it is worth mentioning that the evolution towards circularity requires efforts among the entire value chain, and cannot be limited to furniture producers only, meaning it involves product designers/editors, furniture producers/assemblers, distributors/retailers and architects/interior designers. Companies are increasingly seeking a circular service-based model – instead of just replacing and recycling old products, companies are searching for more and more ways to increase products’ “lifespan” in a sustainable way.

How much of your portfolio includes products that are recyclable? Average % values on total replies

Source: CSIL survey on a sample of office furniture manufacturers worldwide, January 2022. (*) Totally recyclable means at least 80% of the product components.

ASIA PACIFIC OFFICE FURNITURE IMPORTS TO GROW

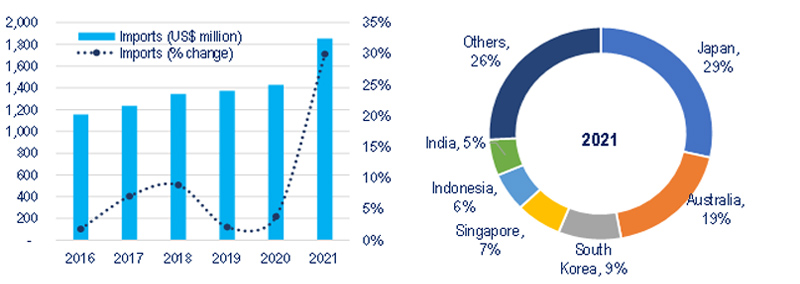

Following years of steady expansion, Asia-Pacific office furniture imports increased significantly also in 2021 with a +30% if compared to the previous year, reaching a value of US$ 1,853 million. Japan is the leading importer followed by Australia and South Korea keeping a combined market share of 57%.

The largest part of supplies originates within the region, especially from China, Taiwan and Malaysia. As far as overseas partners is concerned, the United States, Italy and Poland are the major partners in this business.

Behind statistics we can find elements that outlines current changes in the sector. The jump of 2021 has been quite common in all the major worldwide markets and concerns the exponential growth in the consumption of office chairs (or better, ergonomic work chairs). Once again, remote work, even if only for a couple days of the week, is the driving force behind this trend. It should also be highlighted that this growth was most notable for products in the mid-economic range, as evidenced by the drastic increase seating products coming from Chinese factories.

Asia Pacific. Imports of office furniture, 2016-2021 and share by country in 2021. Million US$ and percentages

Source: CSIL processing

HYBRID WORK: A GAME CHANGER

Remote working is becoming a consolidated method, which is radically changing the connection between home and work environments and taking to the design of ever more hybrid spaces. The pandemic led to increased flexibility for both employers and employees, allowing people to work from different places, with the working week split between home and the office.

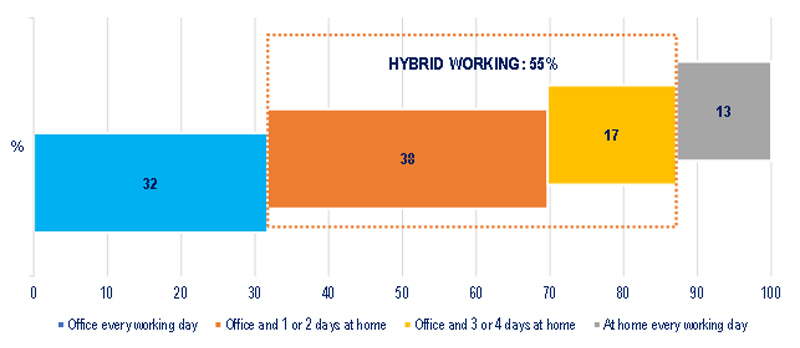

According to a recent CSIL survey, today around 55% of the respondents work both in the company office and at home while the share of employees working at the company office every day stood at 32%. About 13% of the sample declared to work from home only.

The incidence of hybrid working well over the average among young people (less than 35 years old) and is higher among employees of medium and large companies, while being far below average for employees of micro/small enterprises.

Sample. Working location. Percentage shares of number of quotes

Source: CSIL survey “Working From Home”, May-July 2022